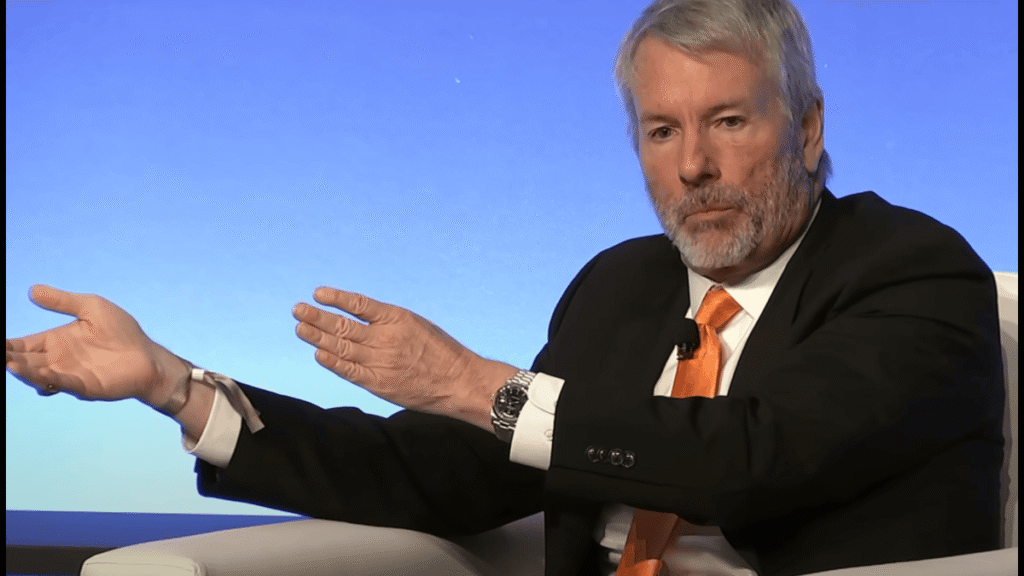

Turning Software into a Bitcoin Empire

Michael Saylor, co-founder of MicroStrategy (MSTR), transformed his software firm into a bitcoin powerhouse by using debt and equity to accumulate over 580,000 bitcoins, worth $40.7 billion. Since 2020, MSTR’s stock has skyrocketed 2,900%, inspiring other companies to follow suit.

A Growing Trend: The Bitcoin Standard

More than 80 publicly traded companies now hold bitcoin as part of their treasury reserves — up 160% since 2023 — according to analyst Gautam Chhugani. About 36 of these firms come from non-crypto sectors like coal, gaming, insurance, and retail.

Trump Media and GameStop Join In

Trump Media (DJT) plans to raise $2.5 billion to build a major bitcoin reserve. CEO Devin Nunes called bitcoin “an apex instrument of financial freedom.”

Meanwhile, GameStop (GME) announced a $500 million bitcoin investment (4,710 bitcoins), aligning with Saylor’s model. However, both stocks dropped around 10% after their announcements, showing market caution.

Saylor’s Simple Pitch

At a recent conference, Saylor summarized:

“Buy bitcoin. Use other people’s money to buy more. Leverage it — and grow.”

He believes bitcoin offers smaller firms a rare shot at big gains in a tech-dominated market.

Risks: Volatility and Scale

Bitcoin is volatile. It surged above $109,000 in January but dropped below $80,000 in April. NYU’s David Yermack warns that leveraged bitcoin strategies risk collapse during sharp downturns.

Chhugani adds: “Not every company can replicate MSTR’s scale and success.”

New Players: Twenty One Capital & Nakamoto Holdings

Twenty One Capital, backed by SoftBank, Tether, and Cantor Fitzgerald, has raised $685 million and plans to go public via a SPAC. Its shares are already up 300%.

Nakamoto Holdings, led by Trump advisor David Bailey, wants to convert 25 companies into bitcoin treasury firms. It’s raised $710 million and will list through a reverse merger with KindlyMD, whose stock soared 370% after the news.

Meme Stock Energy, Real Crypto Risks

Experts compare this wave to the meme stock era — driven by hype, but vulnerable in downturns.

Columbia’s Omid Malekan warns:

“What works in a number-go-up market may crash in a number-go-down market.”

❓ FAQs

1. What is Michael Saylor’s Bitcoin strategy?

Michael Saylor’s strategy involves using debt and equity to buy and hold large amounts of bitcoin on a company’s balance sheet.

2. How many bitcoins does MicroStrategy own?

MicroStrategy owns over 580,000 bitcoins, worth around $40.7 billion.

3. Why are other companies imitating this strategy?

Companies see it as a way to boost returns and stock performance, especially when traditional growth paths are limited.

4. What are the risks of this bitcoin playbook?

The major risk is volatility. A sudden drop in bitcoin’s price could lead to massive losses or bankruptcy for highly leveraged firms.

5. Who else is adopting this strategy?

Notable names include Trump Media, GameStop, Twenty One Capital, and Nakamoto Holdings — among 80+ firms worldwide.